Treasury Secretary Scott Bessent, speaking at a White House Cabinet meeting on July 8, 2025, announced that U.S. tariff collections have already surpassed $100 billion in 2025 and are expected to reach $300 billion by year‑end. This projection reflects an aggressive trade strategy under President Trump, involving a sweeping 10% “reciprocal tariff” on most imports, elevated duties on steel, aluminum, autos, and proposed tariffs on copper, semiconductors, and pharmaceuticals

1. 🔍 Context: A Shift Toward Revenue-Focused Trade Policy

In April, the Trump administration began implementing a 10% universal tariff on imports from nearly all trading partners. This was followed by additional duties on steel, aluminum, and passenger vehicles. As of June, the effective U.S. tariff rate reached 17.6%, marking levels unseen since the 1930s

Since February, the U.S. has also used Section 232 authority to initiate investigations into copper, semiconductors, and pharmaceuticals, paving the way for tariffs as high as 50% on copper and 200% on drug imports

2. 📈 Tariff Revenues Surge — $100 Billion & Counting

Bessent highlighted key figures:

- As of early July, tariff revenue was $100 billion in 2025.

- Total customs receipts for the first eight months of fiscal 2025 hit $86.1 billion, with $63.4 billion collected in the first five calendar months

- May alone brought in a record $22.8 billion—nearly four times the revenue from the same month last year .

- Combined customs and excise tax collections through June stood at over $122 billion

This tsunami of incoming revenue is reshaping the federal budget picture—May’s budget deficit fell by 9% year-over-year, driven largely by customs growth

3. 🚧 Why Tariffs Are More Than Trade Tools

Revenue Generation

Bessent proposed that tariffs are filling a budgetary need: anticipating $300 billion this year—and possibly between $300–600 billion annually in future years

Defense of Domestic Industry

The administration frames tariffs as a tool to re-shore manufacturing, fund domestic infrastructure, and reduce reliance on foreign supply chains

4. 📅 Key Tariff Rollout Timelines

- April 5: 10% universal tariffs took effect.

- Second Quarter: Revised steel, aluminum, and auto duties fully implemented.

- August 1: Deadline for many additional tariffs—particularly copper, semiconductors, and pharma—to begin

- The president emphasized: “The big money will start coming in on August 1”

5. 🔄 Economic Implications

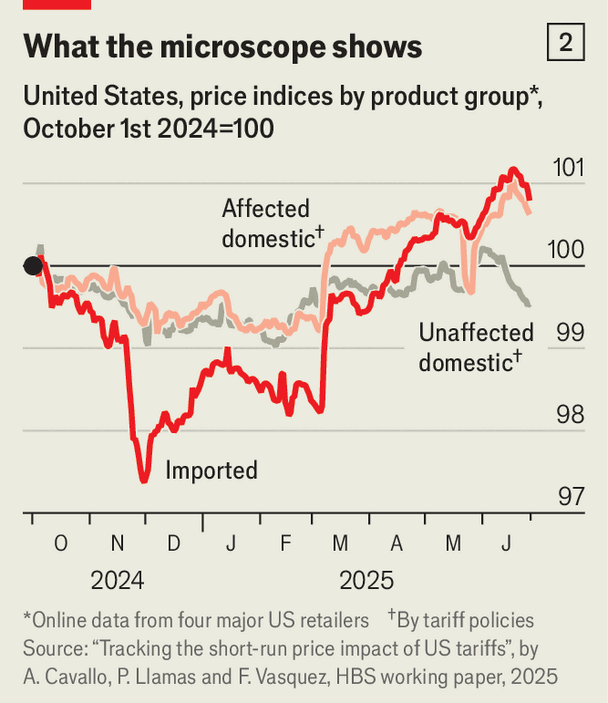

For Consumers & Companies

- Multiple duties “stack” on importers, making forecasting and cost modeling difficult

- Companies like Apple, Ford, Nissan, and HP are rerouting supply chains, investing in U.S. facilities, or adjusting pricing strategies to cope

For Markets & Inflation

- Financial markets have largely desensitized to tariff volatility and see the moves as policy maneuvers more than permanent disruptions

- Bond markets, however, are more cautious. Tariff-driven inflation could complicate Fed rate decisions and raise term premiums

6. 🤔 International & Legal Repercussions

Global Backlash & Negotiations

Letters to trading partners are currently being dispatched, with talks underway to negotiate exemptions or be subject to the new tariffs

Countries like Japan, South Korea, and the EU are lobbying hard. China’s exemption window was later extended by two weeks, amidst notable delay .

Legal Challenges

Multiple lawsuits are awaiting resolution via the U.S. Court of International Trade, some judges already deeming parts of the tariffs exceed the president’s authority. Appeals may delay reversal for months .

7. 🧭 Broader Fiscal and Strategic Consequences

Budget vs. Borrowing

Customs revenues are reducing projected deficits, but market economists warn that reliance on tariffs may destabilize budgets in the long run .

Trade Realignment

Exporters are pivoting operations to lower-risk countries like Southeast Asia and India. Import firms are seeking tariff exemptions or shifting sourcing worldwide

Geopolitical Leverage

Tariffs are being wielded as a geopolitical negotiation tool—for trade, industrial decoupling, and biotechnology strategy.

8. 🧐 Market & Sector Highlights

Key Beneficiaries

- Domestic producers of auto parts, steel, aluminum, and copper may enjoy competitive relief.

- Firms investing in onshore manufacturing (Apple, Ford, Hyundai) are taking advantage of this policy shift.

At-Risk Players

- Import-heavy retailers and manufacturers are adjusting pricing and supply chain models accordingly.

- Consumers may face higher prices in sectors with limited import alternatives.

9. 🧩 Strategic Outlook & Investor Takeaways

- Track August 1—tariffs hitting most partners could amplify economic impacts.

- Monitor legal battles—success or failure in courts could reshape the tariff strategy.

- Evaluate earnings responses—corporate Q3 earnings will reveal the depth of cost pass-through.

- Diversify portfolios—consider industrials, materials with domestic exposure, and inflation-protected assets.

10. 📝 Conclusion

The Treasury’s projection of $300 billion in tariff revenue signals a new era of state-directed trade policy blending protectionism, budget strategy, and industrial planning. While the immediate fiscal boost is clear, the economic, legal, and diplomatic costs are mounting—and global markets are watching.