1. Economic Fears That Never Materialized

Back in April, President Trump unveiled sweeping “liberation” tariffs that triggered sharp stock market drops and spurred widespread predictions of a looming recession Yet by July, U.S. equities rebounded to new highs, business activity remained firm, and consumer spending held strong. The initial alarm gradually gave way to cautious optimism.

2. Tariff Panic: Contained, Not Catastrophic

Though the early shock drove imports and caused a ‑0.5% GDP decline in Q1—the first quarterly contraction in three years—analysts now say companies front-loaded inventory purchases ahead of the tariff deadline, which distorted results . Stripping out volatile import data reveals that real final sales to domestic purchasers rose 1.9% annually—a healthy underlying figure

Goldman Sachs notes that trade uncertainty hasn’t materially derailed GDP, investment, or consumer spending. Instead, global liquidity and businesses delaying expansion into foreign markets have cushioned the blow

3. Consumer Resilience: The Spending Engine

Consumer spending remains the backbone of U.S. GDP—accounting for about 70% of output. Despite some deceleration, PCE growth sits at 0.5% for Q1 and slowed from 2.8% in 2024, yet it remains positive

Wells Fargo highlights four pillars of consumer strength:

- Record real disposable incomes

- Elevated household net worth (~$160 trillion)

- Declining long-term rates

- Ample financial market liquidity

4. The Labor Market: A Stronghold

Though worries arose with a 33,000 job decline in June ADP data, official unemployment remains low at ~4.2%, and nonfarm payrolls added 147,000 in June Bank of America and Hedgeye both confirm that employment fundamentals are solid and inflation pressures are contained

5. Federal Reserve’s Tightrope Walk

Despite economic headwinds, the Fed has kept rates steady and signalled possible cuts—even as core inflation hovers around 3.1% for 2025 Market consensus now places the probability of a July rate cut at just 11%, pushing expectations toward September

6. Structural Evolution and “Mid‑Cycle” Dynamics

The Economist frames the U.S. economy as shifting from “late-cycle” to “mid‑cycle,” with corporate profits and lending demand rising—unusual after past shocks This reflects a resilient and adaptive trend of growth, cushioned by strong institutional support.

7. Macro Forecasts: Tempered Optimism

| Source | 2025 GDP Forecast | Key Drivers & Risks |

|---|---|---|

| Deloitte | 1.4% | Assumes trade relief, tariff easing; upbeat on AI-led productivity |

| Morgan Stanley | ~1.5% | Tariffs hit domestic growth; inflation may peak mid-year; Fed on hold until 2026 |

| JPMorgan & Oxford | <1.5%, recession odds ~35–40% | Moderated risk forecasts; labor-market chill and trade uncertainty seen as manageable |

The broadly held view: slow growth, no recession. The divergence lies in how quickly recovery unfolds and whether trade tensions ease.

8. Policy Backstops: Fiscal & Monetary Tools

Federal stimulus—ranging from infrastructure investment to sector support—continues sustaining confidence. Meanwhile, the Fed remains equipped with “modest tightening,” ready to pivot if inflation drifts

Economist Larry Summers argues that recent tax cuts under the “Big Beautiful Bill” may impose long-term fiscal strain but bolster short-term demand

9. Risks and Watch Points

Despite stability, risks loom:

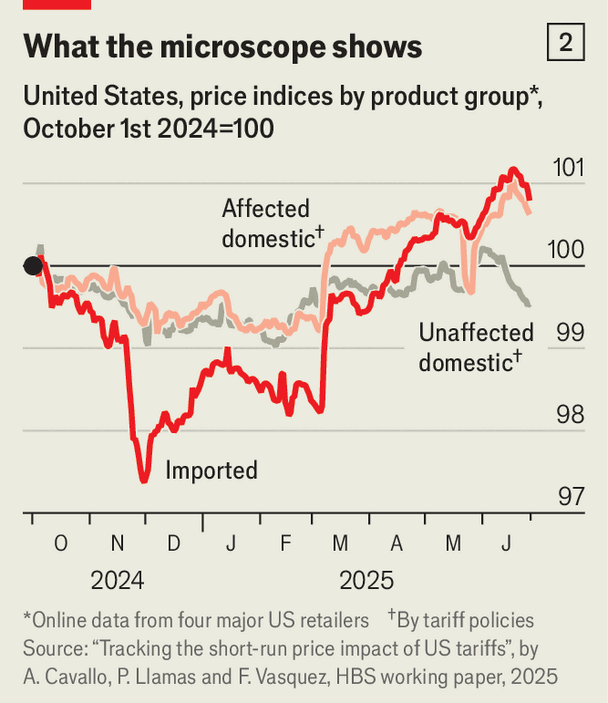

- Tariff escalation or failed trade deals threaten consumer prices and business investment

- Labor market softening could dampen spending .

- Twin deficits—monetary and fiscal—could limit future policy flexibility .

10. Why America Is Dodging Disaster

- Corporate Adaptation – Businesses front-loaded imports and shifted production to buffer tariff costs.

- Consumer Balance Sheets – Strong income and wealth levels hold personal consumption steady.

- Monetary Discipline – The Fed’s proactive posture has kept growth and inflation balanced.

- Structural Flexibility – Mid-cycle dynamics with solid lending and credit markets.

- Policy Agility – Rapid fiscal deployment and potential for targeted stimulus.

11. Conclusion

The U.S. economy has indeed sidestepped a major downturn—but that doesn’t imply immunity. It remains in a slowdown rather than a bust, thanks to a combination of proactive policy, consumer resilience, and strategic buffering.

What comes next depends on: trade negotiations, labor trends, inflation levels, and budget discipline. Should these align, America may see a gradual but sustained recovery. If not, growth may remain sluggish—but the recency of disaster appears avoided.