How will Team USA combine athletic excellence with Business strategy to dominate the 2028 Los Angeles Olympics? With massive funding drives, elite athletes considering staying, and corporate partnerships, can the U.S. translate Business investment into medal-rich success?

3. Business-Driven Headings & Subheadings

Business of Funding: How Much Money Is Backing Team USA?

- Will the U.S. reach its Business goal of $500 million fundraising by 2028? The U.S. Olympic & Paralympic Foundation is targeting $500 million, relying on sponsorship (50%), broadcast deals (37%), and fundraising (~12%)

- In 2025 the USOPC received a record $100 million donation to support athletes—providing $200,000 per athlete per Olympic appearance

Business of Sponsorship: Which Brands Are Fueling the Games?

- LA28 aims to raise $2.5 billion in domestic sponsorships; by mid‑2024 had secured over $1 billion

- Founding and official sponsors include Comcast, Delta, Nike, Visa, Coca‑Cola, Deloitte, AECOM, Cisco, Ralph Lauren and more

Business of Talent Retention: Will Top Athletes Return?

- Simone Biles, Katie Ledecky, Ryan Crouser are considering extending their careers for a home Olympics in 2028

- Rising stars like Caitlin Clark, Angel Reese, Aliyah Boston are expected to lead Team USA women’s basketball by 2028 Talksport.

Business of Infrastructure: Are Cost Savings and Legacy Real?

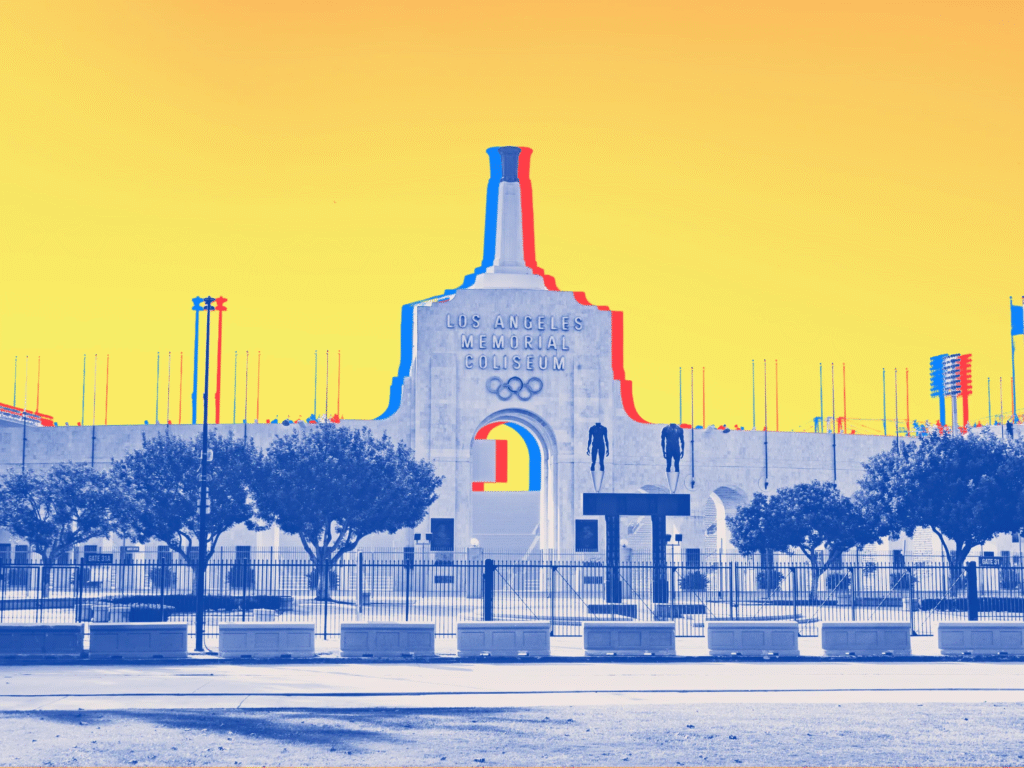

- LA28 is using existing venues (Rose Bowl, Coliseum, Dodger Stadium) to avoid building expensive new facilities, aligning with IOC cost‑containment reforms

- Estimated overall budget is around $7 billion, offset by corporate and broadcast income

Business Operations: Can Governance Match the Athletic Ambitions?

- USATF, the body behind U.S. track and field medal hauls, has faced a $12 million deficit, cancelled events, and delayed athlete pay—raising concerns ahead of LA28

- In response, an independent review has been initiated, and leadership bonuses tied to performance The Wall Street Journal.

Business Engagement: How Are Fans and Communities Involved?

- LA’s infrastructure upgrades (Metro transit lines, venue access, shuttle networks) are being integrated with Business planning, though progress has been uneven across neighborhoods

- Nonprofits like the LA84 Foundation continue promoting youth sports as part of the Olympic legacy Business ecosystem

4. Famous Names, Quotes & Stats

- Caitlin Clark and Angel Reese are expected to bring both star power and commercial lift to WNBA and Team USA marketing

- Simone Biles has said she “has not ruled it out” competing at age 31 in LA, and Katie Ledecky has expressed her intention “year by year” to possibly add a fifth Olympics

- CEO John Slusher, formerly at Nike, is leading U.S. Olympic commercial operations with a Business background at

- Quote on infrastructure: “The Games have a history of damaging the cities and societies that host them … broken budgets … expulsion of residents” — a caution on Business planning challenges

- USATF performance vs finance: “No Olympic team on the planet is more decorated … yet facing major financial challenges” despite $862 medals

5. FAQs (Business‑style Q&A)

Q: What is the Business model behind Team USA’s funding?

A: It is a hybrid Business model—corporate sponsorship (~50%), NBC broadcast royalties (~37%), philanthropic and fundraising (~10–12%)

Q: Will veteran stars compete to boost Business and medal prospects?

A: Yes: Biles, Ledecky, Crouser have publicized the potential of stretching their careers to compete on home soil, enhancing both medal potential and marketing value The Guardian.

Q: Are cost overruns less of a problem for LA28 compared to other Games?

A: LA is reusing existing venues and pursuing a $7 billion budget, a leaner Business strategy—but past Games have historically seen cost overruns over 100%

Q: Can financial mismanagement in USATF impact medal outcomes?

A: Yes: recent USATF deficits, canceled events, prize delays could affect athlete prep and performance unless reformed in time

Q: How are infrastructure upgrades supporting Business objectives?

A: Olympic transit and venue upgrades improve fan access and urban mobility, creating Business legacy value, though delivery is uneven across L.A. districts

6. Transition‑Rich Section: Why All This Business Matters to Winning Gold

First, funding matters: without sufficient Business support, athletes cannot train or compete optimally. The $100 million donation and fundraising campaign help reduce financial stress and allow elite focus. Then, sponsorship and marketing, via global brands like Coca‑Cola and Nike, elevate athlete visibility and fan engagement. Next, infrastructure enables better logistics—venues and transport shape athlete schedules and spectator experience. Without governance aligned with Business strategy, as seen in USATF’s struggle, performance can suffer. Finally, veteran stars staying on for LA2028 combines Business storytelling with strategic continuity.

7. Key Takeaways

| Business Pillar | Insight |

|---|---|

| Funding | $500M campaign + historic $100M gift ensures athlete support and strategic stability |

| Sponsorship | Over $1B secured toward $2.5B target; global brands fuel both funding and marketing |

| Athlete Retention | Stars like Biles, Ledecky, Clark provide medal hope and commercial visibility |

| Venue Strategy | Reuse of existing venues helps contain cost and aligns with IOC Business reforms |

| Governance Risk | USATF deficits and event cuts threaten preparation unless reformed soon |

| Infrastructure Legacy | Transit and venue upgrades aim to support business, community and Olympic access |

8. Conclusion & Outlook: Business Strategy vs Olympic Success

Can the U.S. win big at the 2028 Olympics? That depends on how well Business strategy aligns with athletic performance. With robust fundraising, high-level corporate sponsorship, plans for returning star athletes, cost-controlled infrastructure, and reform at governing bodies, the Business foundation is strong. Yet financial mismanagement, delays in local infrastructure, and uncertainty in athlete commitments pose risks.

If Team USA can execute its Business model effectively—leveraging funding, athlete branding, operational efficiency, and urban readiness—it stands a strong chance to dominate medal tables on home soil. But without timely reforms and consistent execution, even the U.S.’s unmatched athletic pedigree may struggle to convert Business investments into gold.