The American pension system is facing a crisis that threatens the retirement security of millions of workers. Despite improvements in some areas, the overall landscape remains precarious, with many individuals unaware of the risks to their pensions. This article delves into the current state of pensions in the U.S., highlighting key statistics, challenges, and steps individuals can take to safeguard their retirement futures.

The State of Public Pensions in 2024

Funding Status

As of 2024, U.S. public pension funds have shown some improvement, with the average funded ratio increasing to 80.2% from 75.5% in 2023. This uptick is attributed to strong investment returns averaging 10.3% for the fiscal year. However, experts caution that these gains are not sufficient to eliminate the underlying financial fragility of many pension systems. American City & County

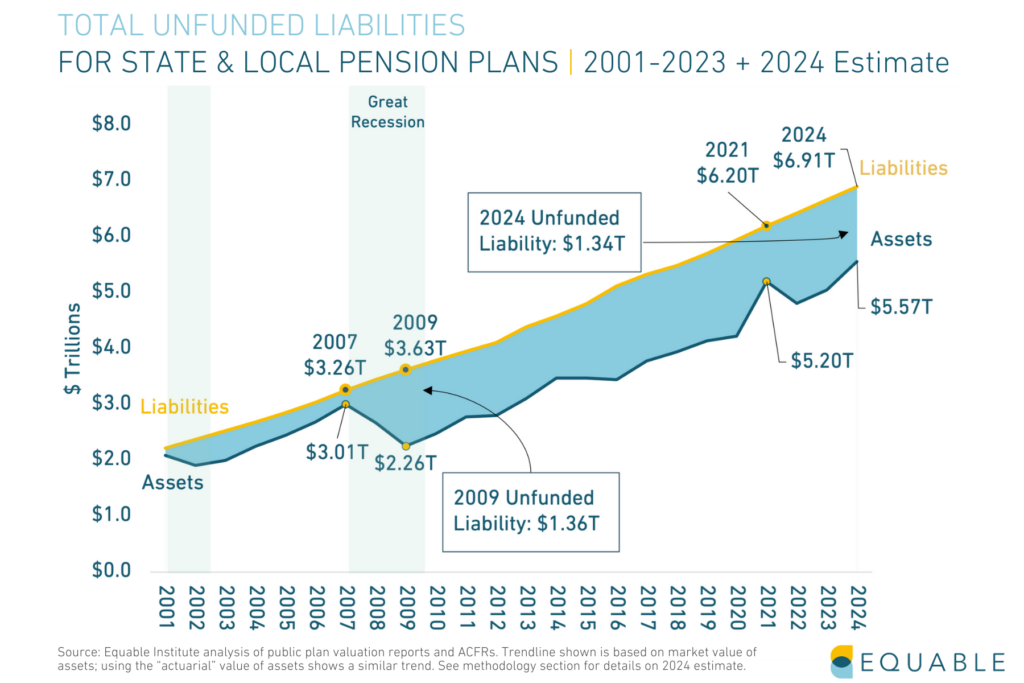

Unfunded Liabilities

Despite the positive returns, the total unfunded liabilities for public pensions remain substantial. In 2024, the funding shortfall declined to $1.37 trillion, down from $1.64 trillion in 2023. While this represents progress, the gap is still significant, and many pension plans continue to struggle with long-term sustainability. Reason Foundation

Challenges Facing Pension Systems

Demographic Shifts

The aging population poses a significant challenge to pension systems. As life expectancy increases and birth rates decline, the ratio of workers to retirees is shrinking. In 1950, there were 7.2 working-age individuals for every retiree; by 2050, this is projected to decrease to just 2.1. National Council on Aging

Economic Pressures

Economic factors such as inflation, market volatility, and low interest rates have impacted the performance of pension investments. These economic pressures have made it more difficult for pension funds to meet their long-term obligations, leading to increased unfunded liabilities. Fiducient Advisors

Policy and Legislative Issues

Inadequate funding and inconsistent contributions from employers have exacerbated the pension crisis. Some states have taken steps to address these issues by increasing employer contributions and implementing reforms, but progress has been slow and uneven. Pew Charitable Trusts

Impact on Retirees

Financial Insecurity

A significant portion of retirees are experiencing financial insecurity. A 2024 study found that 80% of older adults are either financially struggling or at risk of economic insecurity as they age. Investopedia

Dependence on Social Security

Many retirees rely heavily on Social Security benefits, which may not be sufficient to maintain their standard of living. Concerns about the future of Social Security further compound the uncertainty for retirees.

Steps to Protect Your Pension

Diversify Retirement Savings

Relying solely on a pension may not be prudent. Individuals should consider diversifying their retirement savings through vehicles like 401(k)s, IRAs, and other investment options to build a more secure financial future.Pew Charitable Trusts

Stay Informed

Regularly review your pension plan statements and stay informed about any changes to your benefits or the financial health of your pension system. Engage with your plan administrators to understand your options and rights.

Advocate for Reform

Advocate for policies that strengthen pension systems, such as increased employer contributions, improved investment strategies, and legislative reforms that ensure the long-term sustainability of pension funds.

Conclusion

The pension crisis in the U.S. is a complex issue that requires immediate attention and action. While some improvements have been made, significant challenges remain. By staying informed, diversifying retirement savings, and advocating for necessary reforms, individuals can take proactive steps to protect their retirement security.