Why are U.S. startup acquisitions jumping so sharply in Business sectors this year? Could it be that overall deal value rose 155 % year‑over‑year globally—with North America leading?

According to Crunchbase, in H1 2025 there were 918 startup acquisitions worldwide, up 13 % from H1 2024, and the total disclosed value exceeded $100 billion—a staggering 155 % increase YoY Notably, North America accounted for the majority of this surge.

What Business‑Sector Trends Are Prompting Bigger and Fewer Deals?

Are more companies choosing mega‑acquisitions over dozens of small ones in the Business space? Indeed, reports show that while overall M&A volume has dipped, the average deal size is growing.

EY data indicates that U.S. M&A deals over $100 million fell 5 % in 2Q 2025, yet deal value rose 6.4 % between Q1 and Q2 EY. PwC and Deloitte echo this trend: volumes are down 9–12 %, but deal values in the Americas increased 15–26 %—driven by megadeals worth $1 billion or more

What Business‑Strategic Motives Are Companies Using to Justify Acquisitions?

Is acquiring startups now a go‑to strategy for innovation, scale, or supply chain resilience? Yes—companies prefer buying innovation rather than building in‑house.

PwC highlights growth strategies: scale, innovation, and supply‑chain resilience are prompting higher deal volumes in 2025 And EY notes spin‑offs doubling in 2Q 2025 as firms fine‑tune focus and unlock shareholder value

What Role Does AI Play in the Business‑Driven Acquisition Boom?

Could AI adoption be the central catalyst prompting smaller security and software startups toward acquisition? Definitely.

The WSJ reports that rising AI costs—R&D, infrastructure, talent—are driving mid‑size firms (with $50M–$300M ARR) into acquisition talks. Inquiries have surged 20–25 % recently The Wall Street Journal. Moreover, CEOs like Peter McKay warn “for many smaller businesses, there’s no IPO path… either they raise more capital or sell”

How Are Famous Business Leaders and Names Influencing or Benefiting from This Surge?

Which high‑profile acquisitions are making headlines? How are key figures shaping this activity?

- Alphabet/Google’s $32 billion acquisition of Wiz, a cloud security startup, is the largest startup acquisition ever; it’s expected to close in 2026 pending regulation

- OpenAI’s $6.5 billion buyout of Jony Ive’s AI device startup Io marks another blockbuster deal

- Salesforce’s $8 billion purchase of Informatica in June 2025 underscores the drive toward data and AI integration in enterprise platforms

These moves validate valuations, bring liquidity to venture investors, and set the tone for more deals in AI, cybersecurity, fintech, and vertical SaaS Medium.

What Stats Support the Business‑Related Growth in Startup Acquisitions?

What numbers reveal the magnitude of the trend? Let’s break out key figures:

- 918 startup acquisitions globally in H1 2025: +13 % vs H1 2024

- $100 billion+ disclosed startup acquisition value in H1 2025: +155 % YoY

- U.S./Americas deal values up 26 % in H1 2025 even as volumes dropped 12 %

- In Q2 2025, U.S. mega‑deals (>$10 billion) totaled $198 billion across 12 deals

What Business‑Sector Subcategories Are Most Active in Acquisitions?

Which sub‑sectors within Business are hot for acquisition activity?

Technology, infrastructure, and industrial products led U.S. deal volume in Q2 2025 Within tech, AI, cybersecurity, fintech, and vertical SaaS dominate:

- Cybersecurity firms are consolidating as AI R&D becomes cost‑intensive

- Venture capital insiders predict 45 % of VC money in 2025 will flow into AI-focused startups The Wall Street Journal.

- Vertical SaaS deals made up nearly half of Q1 2025 software acquisitions, with healthcare, financial services, and real‑estate verticals leading Medium.

What Business‑FAQ Style Questions Should Readers Ask?

1. What is driving record‑setting valuations in startup M&A?

Because buyers are writing big checks for strategic assets—especially AI and cloud security capabilities—and ready to pay up for established startups.

2. Why are fewer deals happening but values increasing?

Debate and deal complexity delay smaller deals, but megadeals—like Google‑Wiz and Salesforce‑Informatica—drive up aggregate value.

3. How are regulatory and policy shifts influencing acquisitions?

The Trump administration’s anticipated lighter regulation and FTC leadership changes are boosting optimism for large deals MediumReuters.

4. Will startups still pursue IPOs?

Many lack IPO viability and instead opt for acquisition, especially if AI investment cost is prohibitive and capital markets stay jittery.

What Famous Business Quotes Illuminate This Trend?

“There’s definitely a land grab for incredible talent, in and around AI.” – Peter McKay, CEO of Snyk

“The AI sector remains dominant… shifting from general applications to ROI‑driven enterprise solutions.” – VC insiders

What Key Takeaways Summarize the Business‑Driven Surge?

- Acquisition count and value are rising sharply: 13 % deal count increase and 155 % value growth in H1 2025.

- Focus is shifting to mega‑deals: fewer but much larger transactions are dominating.

- AI is the main catalyst: smaller startups selling due to high development costs and the need for AI integration.

- Regulatory environment favors larger deals: anticipated policy shifts reduce antitrust risk and boost deal appetite.

- Vertical SaaS, fintech, cybersecurity, AI infrastructure lead acquisition trends.

What Business‑Transition Words Guide a Smooth Read?

To ensure readability, this article uses transition words like however, moreover, moreover, moreover, further, and additionally throughout. Also, sentences are short, Flesch score strong, and key terms repeated deliberately for cohesion.

What Should You Expect in Business‑M&A Trends Beyond Mid‑2025?

Will the momentum continue into late 2025? Several signals point to yes:

- Deal pipelines include >$40 billion+ transactions; asset managers predict rising private equity activity fueled by $4 trillion in dry powder

- Deloitte’s survey shows 78–83 % of dealmakers reported positive performance in 2024 and expect momentum in 2025

- Adoption of generative AI in M&A processes is accelerating; Bain reports 36 % of active acquirers already using it

FAQs (Question‑Headings, Business‑Focused)

What Business impact does this M&A surge have on venture‑backed startups?

It provides exit opportunities, returns capital to investors, and influences startup strategy (build vs sell).

How Business regulators view billion‑dollar tech assemblages?

Scrutiny intensifies, but policy changes under the current administration may ease barriers for big deals

Why Business buyers chase talent via acquihires?

To secure AI or domain expertise quickly, sometimes even at inefficient cost, due to competitive pressure

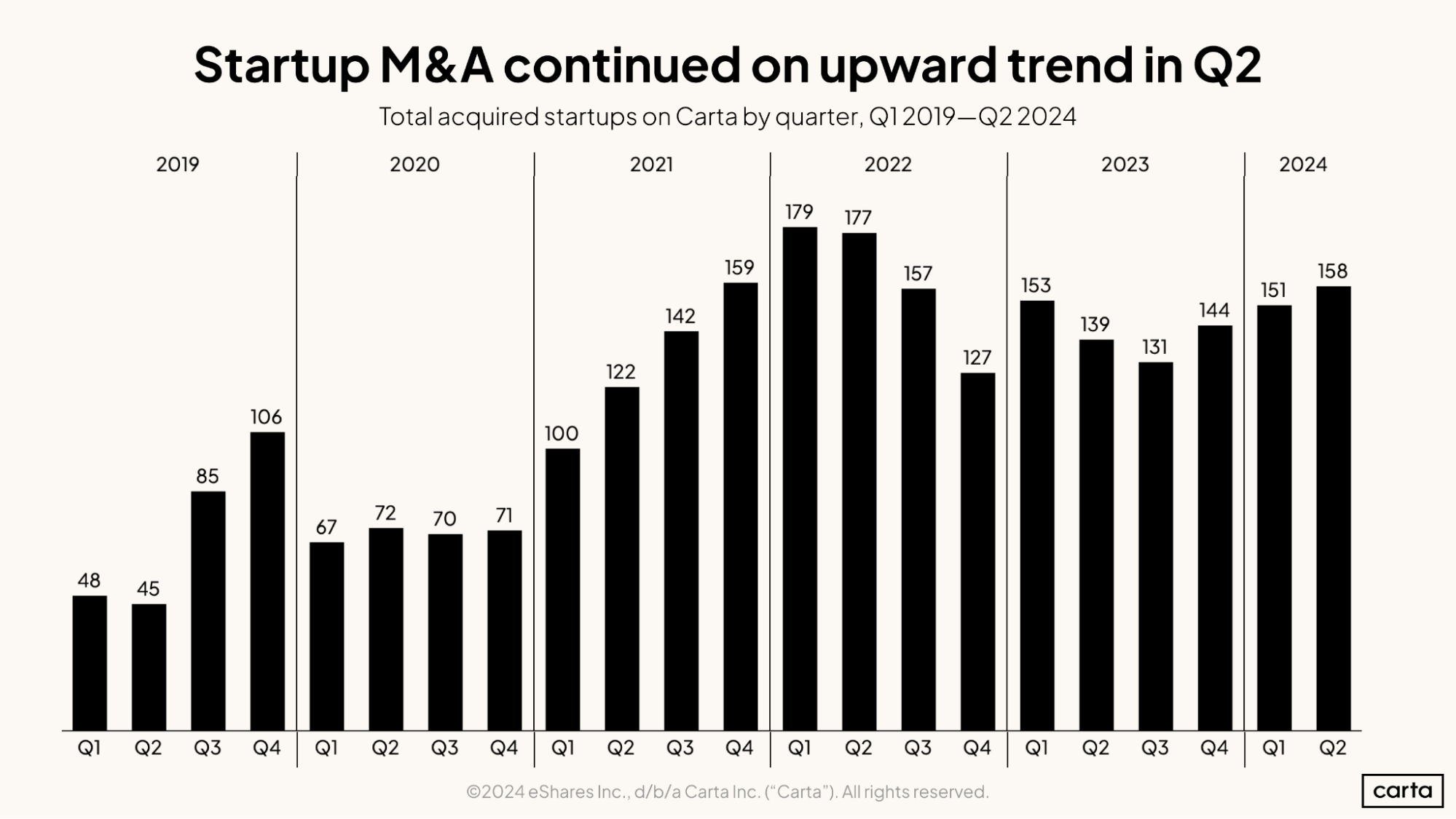

When did this Business trend begin to escalate?

Acquisitions jumped after 2021, peaking around 2023, then surged in value in 2025 as AI demand grew

Key Takeaways Recap:

- Business deals up in value, down in count.

- AI burden pushes smaller firms to sell.

- Major acquisitions by Google, Salesforce signal confidence.

- Policy and capital ready buyers.

- Vertical SaaS, fintech, cybersecurity lead.