New York, June 10, 2025 — The U.S. automotive engine oils market, currently valued at about $3.19 billion in 2025, is projected to reach $4.23 billion by 2032, growing at a 4.1% compound annual growth rate (CAGR)—according to a fresh forecast from Persistence Market Research (PMR)

This forecast underscores a robust and enduring demand for engine lubricants amid evolving automotive trends—from widespread passenger car use to the growing appeal of advanced synthetic oils.

🌟 Key Drivers Behind Growth

- Expanding Vehicle Parc and Aging Fleets

- The living and working shift toward remote and suburban lifestyles in the post-pandemic era has sustained high vehicle ownership.

- U.S. drivers are holding onto their cars longer, increasing the need for periodic oil changes

- Rise of High-Performance Engines

- Modern fuel-efficient engines feature tighter tolerances, higher operating temperatures, and turbocharging. These designs rely heavily on premium synthetic oils to ensure protection and fuel economy

- Consumer Awareness and Quick Lube Boom

- Lifelong vehicle owners and millennial car buyers value engine longevity and efficiency.

- The proliferation of quick-lube service centers has made professional lubricant maintenance more accessible and frequent

- OEM Approvals and Brand Trust

- Many oil brands are now backed by original equipment manufacturer (OEM) certifications, which adds credibility and drives consumer preference in maintenance decisions .

📈 Market Segmentation

a) By Vehicle Type

- Passenger cars form the core of demand, given their prevalence and consistent need for engine care.

- Commercial vehicles — including light and heavy-duty trucks — also contribute significantly, due to higher usage and MAP-accumulating miles requiring more frequent service.

b) By Oil Grade

- Fully synthetic oils lead in growth rates, boosted by consumer trust in their superior properties: thermal stability, longer drain intervals, and reduced engine deposits

- Semi-synthetic oils remain a cost-effective strategy, particularly for mid-tier drivers.

- Mineral oils, while still in use, are losing share due to performance limitations and regulatory pressure.

c) By Region

- The Southwest U.S.—notably states like Texas and Arizona—dominates demand due to widespread vehicle ownership and harsher driving conditions that necessitate more frequent oil changes

🔢 Market Size: Projections & Benchmarks

- 2025 value: $3.193 billion; expected to rise to $4.23 billion by 2032

- Growth rate: 4.1% CAGR between 2025 and 2032 based on PMR study

- Global comparison: Estimates place the U.S. market at $6.36 billion in 2024, rising to $7.13 billion by 2030 (1.9% CAGR)—indicating a global slowdown versus the U.S.’s strong performance.

⚠️ Opportunities & Challenges

Opportunities

- The trend toward premiumization in lubricants is growing fast; drivers and fleet operators are willing to pay more for perceived engine protection and longer service life

- Hybrid vehicles, while requiring both combustion and electric systems, create a niche for specialized semi- and fully-synthetic oils catering to higher-performance needs .

Challenges

- EV penetration: Electric vehicles require no engine oil, presenting a sector risk as EV market share expands

- Raw materials cost volatility: Fluctuating oil and additive prices affect manufacturer margins and pricing stability

- Extended oil service intervals: More efficient engines and advanced synthetic formulas have lengthened change intervals, slightly reducing turnover volumes

🏭 Competitive Landscape

The U.S. engine oils market is highly fragmented, featuring both global and regional players.

Key Brands Include:

- Valvoline Inc., Castrol Ltd., ExxonMobil, Chevron, Shell, Total Energies, Amsoil, Fuchs, Petronas, and Würth Group

Market Movements:

- Established oil companies are expanding R&D in fuel-efficient lubricants, and partnering with OEMs for compliant performance fluids.

- Mergers and acquisitions are also shaping portfolios—for example, Cadence Petroleum Group’s acquisition of R.W. Davis Oil in 2025 highlighted consolidation trends

🌐 Broader Industry Context

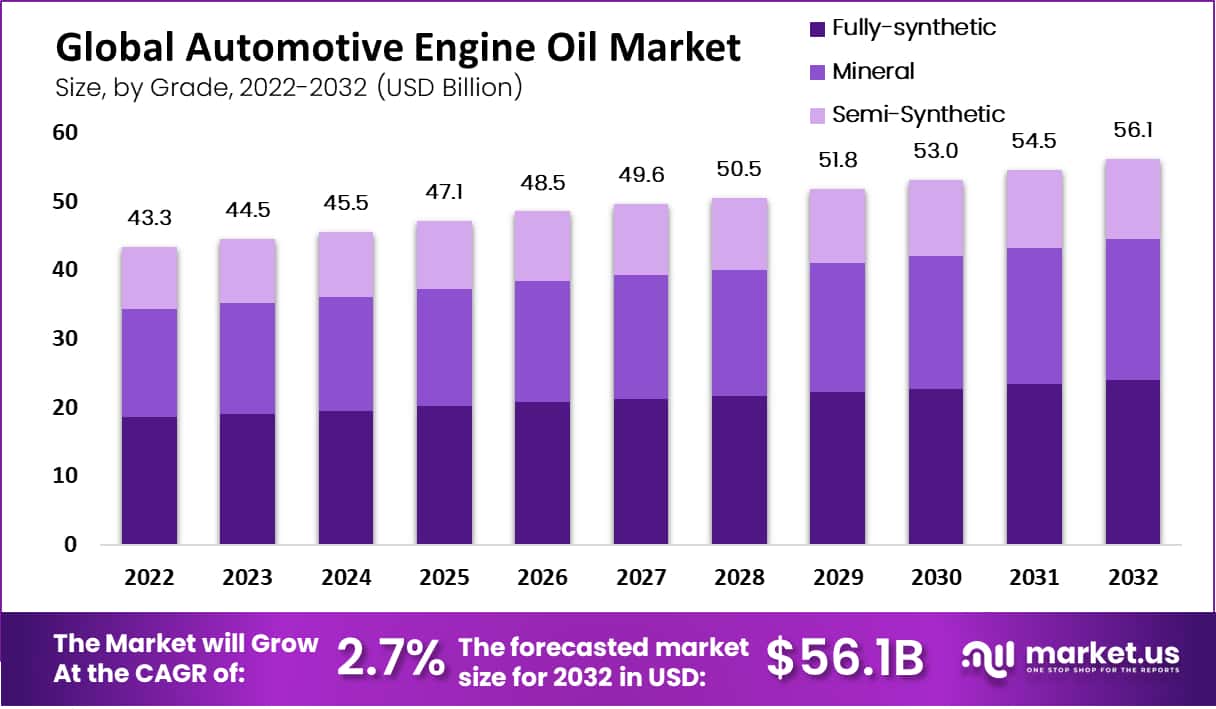

- The global automotive engine oil market is projected to grow from $43.3 billion in 2025 to $57.4 billion by 2032 at a 4.1% CAGR

- North America, led by U.S. demand, will maintain significant global share, while APAC—notably China, India, and Japan—emerges as the fastest-growing region

🔮 Outlook 2032: What Lies Ahead

- Fully synthetic oils will likely become dominant in premium, and even mid-tier, vehicle segments as carmakers mandate them for performance and emissions compliance.

- Service behavior may shift with longer oil change cycles, but robust volumes will sustain via vehicle fleet longevity and high-mileage usage patterns.

- EV growth remains a natural counterpoint—expect lubricant companies to diversify into coolants, transmission fluids, or EV-specific lubricants to offset declines.

- Policy & environmental pressure may drive lower-viscosity oils and green formulations, aligning with fuel economy and emission reduction goals.

🧭 Final Take: A Market in Transition

The U.S. automotive engine oils market is on a steady growth trajectory, surpassing expectations—outpacing global averages. Robust passenger vehicle demand, engine technology trends, and a shift toward premium lubricants underpin this rise.

By 2032, despite an accelerating EV wave, internal combustion engine trends will fuel a $4.23 billion lubricants market, mapping out a critical chapter in America’s automotive aftermarket story.

—but companies should balance it with strategic pivots into EV fluid segments and environmental innovation to sustain momentum amid a changing mobility landscape.