As 2025 unfolds, Decentralized Finance (DeFi) has transitioned from niche innovation to a mainstream force reshaping American financial services. In an ecosystem that promises autonomy, cost-efficiency, and innovation, banks, fintechs, regulators, and consumers are grappling with its implications. This piece explores DeFi’s rise, its impact on U.S. banking, the regulatory landscape, challenges, and the strategic opportunities it presents.

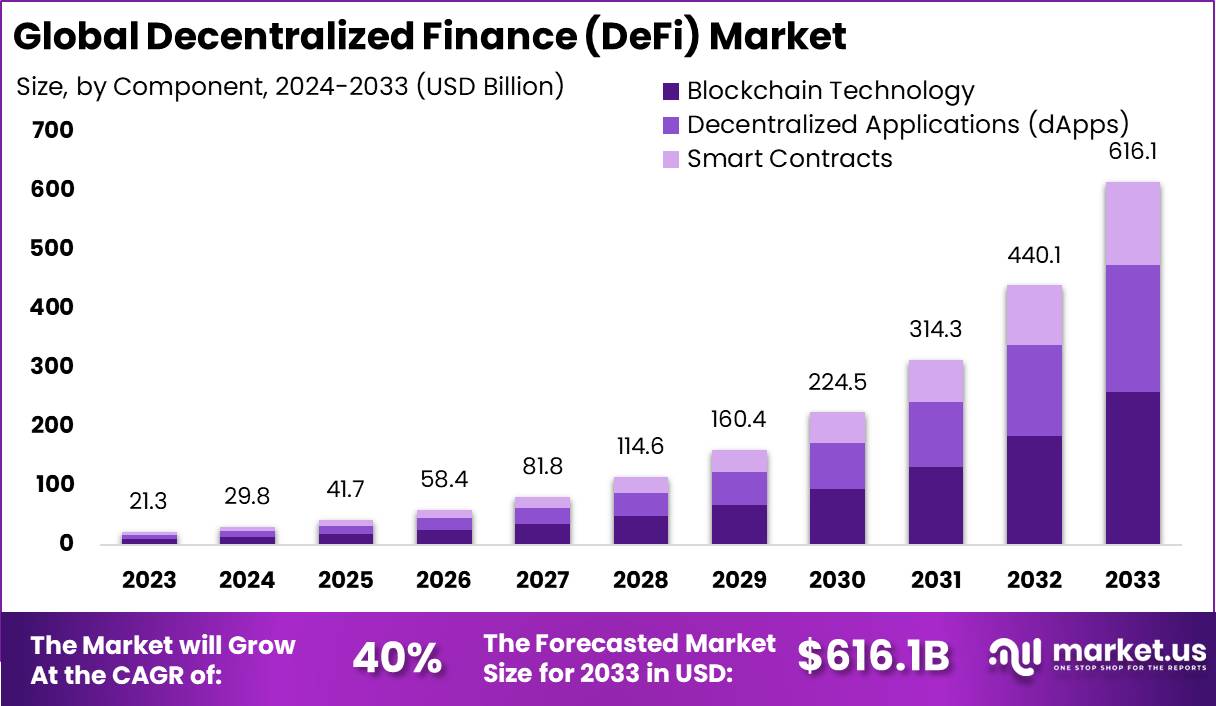

1. 📈 DeFi at a Glance: Scale & Growth

Demand for transparent, permissionless financial solutions has sparked a flourishing DeFi ecosystem. Powered by Ethereum, blockchain, and smart contracts, DeFi enables peer-to-peer lending, borrowing, trading, insurance, and tokenized asset management—without centralized intermediaries

- Market size: Forecasts estimate U.S. DeFi revenue around $2.5 billion in 2025, with North America targeting $3 billion, accounting for ~8% user penetration

- Institutional engagement: Traditional giants like Goldman Sachs and Citi are integrating tokenized deposits and DeFi-derived tools, signaling rising institutional interest

2. ⚠️ A Threat to Traditional Banking?

A. Disintermediation of Services

DeFi replaces intermediaries, enabling lending and borrowing with minimal fees—challenging banks’ core revenue from payment processing, interchange, and loan servicing

B. Deposit Competition

Stablecoins backed by U.S. dollars offer instant, digital liquidity that can lure depositors away from banks. The U.S. Treasury warns up to $6.6 trillion in bank deposits could migrate to stablecoins if regulation isn’t addressed

C. Margin Revenue Impacts

As DeFi allows for decentralized lending and trading, banks may lose high-margin revenues from underwriting, asset management, and derivatives services

D. Operational & Cyber Threats

Smart‑contract vulnerabilities and hacks have already cost billions in DeFi—exposing weaknesses in digital finance that could pressure banks to escalate cybersecurity investments

3. 💡 Or an Opportunity in Disguise?

A. Blockchain Integration

Banks recognize the efficiencies of smart contracts—enabling straight-through processes and same-day settlements. Citigroup, HSBC, and State Street are piloting tokenized deposits, gold, and treasuries reducing costs and systemic friction.

B. Tokenized Assets & Product Innovation

Firms like Securitize handle $2.8 billion in tokenized treasuries and securities—demonstrating mass asset tokenization and compelling banks to create hybrid custodial‑token platforms

C. Yield Generation & Liquidity Tools

DeFi protocols pioneer yield farming and liquidity pools. Banks may respond by offering tokenized wealth products or engaging in DeFi directly through hedged treasury strategies .

D. CBDCs & Regulatory Convergence

Stablecoins are prompting U.S. legislators to introduce frameworks like the GENIUS Act, signaling a structural shift toward formal digital currencies

4. 🏛️ The Regulatory Crossroads

A. Stablecoin Regulation

The GeniUS and STABLE Acts seek to mandate issuer audits, reserve backing, and limit interest‑bearing stablecoins. These guardrails aim to protect banks and consumers while allowing innovation

B. SAME‑RULES, SAME‑RISK Expectations

Regulators advocate for extending deposit insurance or oversight (e.g., AML/KYC, capital buffers) to DeFi—bringing the principle of “same activity, same risk, same rule” into crypto territory

C. Pioneering Federal Frameworks

The bipartisan Senate passage of the GeniUS Act on June 17 sends a clear signal—stablecoins and DeFi are inching toward regulated legitimacy in U.S. banking

5. 🔧 Challenges Ahead

A. Smart Contract Risks

Code-based contracts lack recourse for users—vulnerabilities have led to $1.9 billion in losses in 2023 alone

B. Fragmented Regulation

Multiple regulatory bodies—SEC, CFTC, Treasury—create gaps and jurisdictional friction. Harmonizing these frameworks remains a major hurdle .

C. Institutional Adoption Barriers

Banks are waiting for clearer legal and compliance guardrails before committing deeply—ISO 20022 and CBDC pilots may pave the way .

D. Scalability & Interoperability

DeFi success depends on scalable blockchains and cross-chain bridges. Network congestion and siloed models still hamper mainstream usability

6. 🔄 Strategic Roadmap for Banks

| Strategy | Description |

|---|---|

| Pilot Tokenized Assets | Collaborate with fintech/platforms for custodied token treasuries, gold, or securities. |

| Hybrid Solutions | Launch regulated DeFi-like savings and lending via platform partnerships (e.g., WeFi, Cashaa) |

| Compliance-First Approach | Develop AML/KYC and smart contract auditing protocols to ensure safety and resilience. |

| Institutional Integration | Offer DeFi tools to institutional clients—hedging, tokenized instruments, liquidity pools. |

| Regulatory Engagement | Be active participants in policymaking—aligning with frameworks like GENIUS and Basel Accords. |

7. 🗣️ Industry Perspectives

- Moody’s analysts warn stablecoins could constrain banks’ lending capacity and undermine fee income—though major banks have resilience to adapt

- Goldman Sachs and JP Morgan are methodically engaging through controlled pilots in crypto trading and tokenized product development .

- IMF and fintech experts advocate that true integration requires DeFi to adhere to “same risk, same rule,” emphasizing need for consumer safeguards

8. 📉 Risks if Left Unaddressed

- Unregulated DeFi could erode bank deposits and spur rate hikes on retail savings.

- Fragmented regulation may invite illicit activity into financial pipelines.

- Consumer losses from DeFi hacks could damage trust in digital banking.

- Overreaction by regulators could stifle innovation and drive finance offshore.

9. 🔮 What Lies Ahead

- 2025–26: Banks pilot tokenized assets, stablecoin frameworks advance, GeniUS Act potentially becomes law.

- 2027–28: CBDC trials and ISO 20022 rollouts standardize cross-border digital finance.

- By 2030: A hybrid financial ecosystem—banks + DeFi—may dominate. Early adopters will shape the blueprint.

✅ Final Verdict: Threat or Opportunity?

DeFi challenges banks—but not necessarily destroys them. The choice lies in integration vs. resistance:

- Resistant banks may lose relevance as customers migrate toward low-cost, blockchain-native financial services.

- Adaptable banks that embrace tokenization, smart contract frameworks, and robust compliance can thrive—leveraging DeFi to enhance core offerings and unlock new business models.